Business Insurance in and around Memphis

Calling all small business owners of Memphis!

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Whether you own a a stained glass shop, a bakery, or a home improvement store, State Farm has small business coverage that can help. That way, amid all the various moving pieces and options, you can focus on navigating the ups and downs of being a business owner.

Calling all small business owners of Memphis!

Almost 100 years of helping small businesses

Keep Your Business Secure

Each business is unique and faces specific challenges. Whether you are growing a hobby shop or an auto parts shop, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Michelle Wilson can help with a surety or fidelity bond as well as life insurance for a group if there are 5 or more employees.

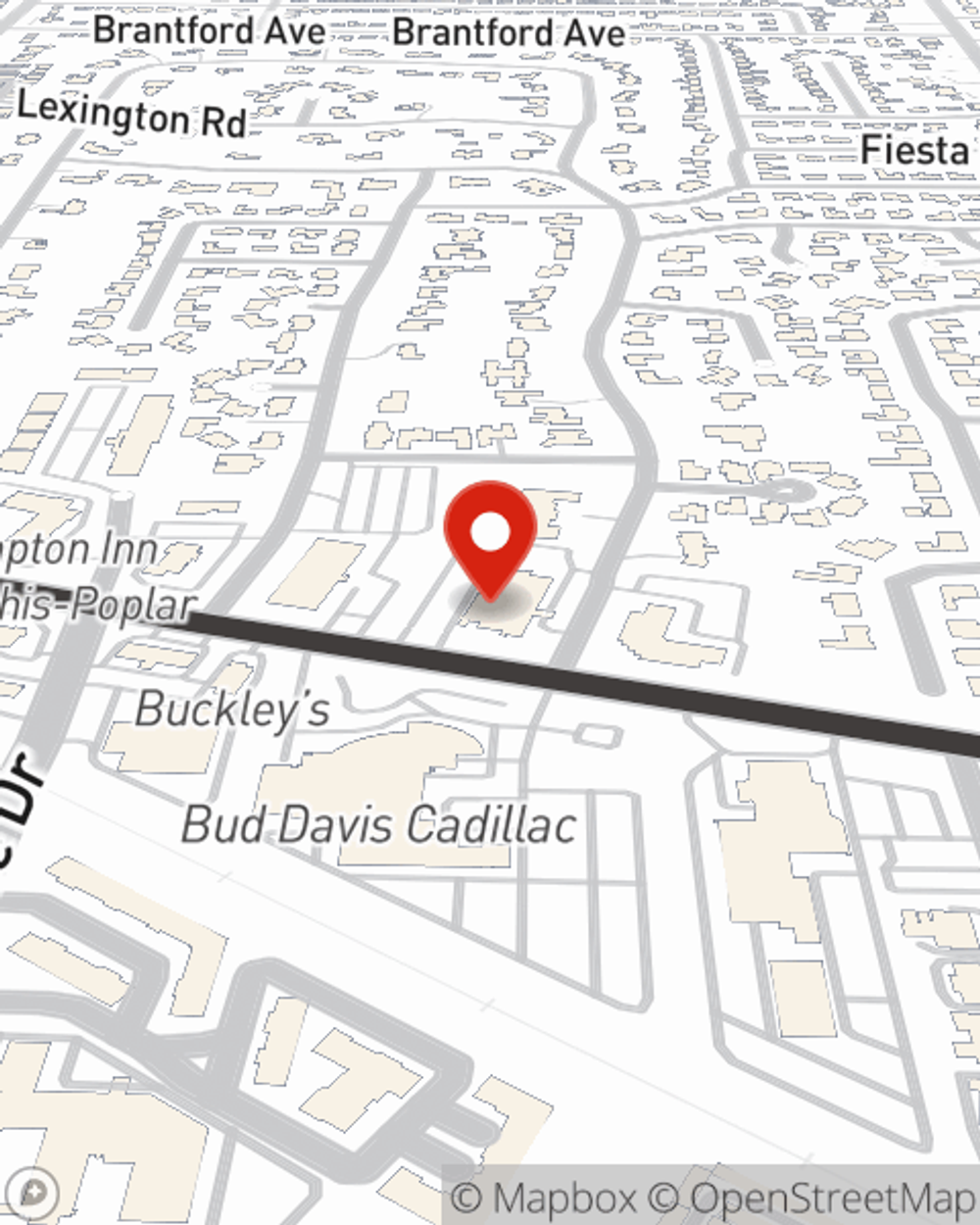

As a small business owner as well, agent Michelle Wilson understands that there is a lot on your plate. Get in touch with Michelle Wilson today to discover your options.

Simple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Michelle Wilson

State Farm® Insurance AgentSimple Insights®

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.